“Consumer discretionary” is a term used to describe goods and services that are viewed as being non-essential by consumers, but desirable if they have the disposable income to purchase said goods and services.

On the “goods” side, you have physical items like apparel, leisure-time products, and even automobiles, which are technically non-essential depending on who you ask.

The “services” side includes hotels, casinos, leisure facilities (like theme parks), restaurants, and other non-essential diversified services.

Many analysts see the sale of consumer discretionary goods and services as an important economic indicator, as the purchase of those goods and services is influenced by the economy.

If the economy is strong, consumers should theoretically have more disposable income to spend on non-essential goods. Economists took things one step further by creating the consumer confidence index, which attempts to measure the degree of optimism consumers have surrounding the U.S. economy.

And despite fears of a recession that have lingered since late 2018, consumer confidence continues to grow.

Primarily as a result of strong discretionary spending.

The SPDRs Select Sector Consumer Discretionary ETF (NYSE: XLY), an exchange traded fund that tracks consumer discretionary spending, is up over 20% on the year.

However, just a few weeks ago the XLY took a nosedive after the Fed’s rate cut announcement and a series of Trump tweets were released about raising tariffs.

It was a 1-2 punch that sent the XLY reeling, even though the most recent consumer confidence index reading still showed that consumers were optimistic. As a result, investors are now starting to buy back into companies in the sector, and it appears as though a recovery could be starting soon.

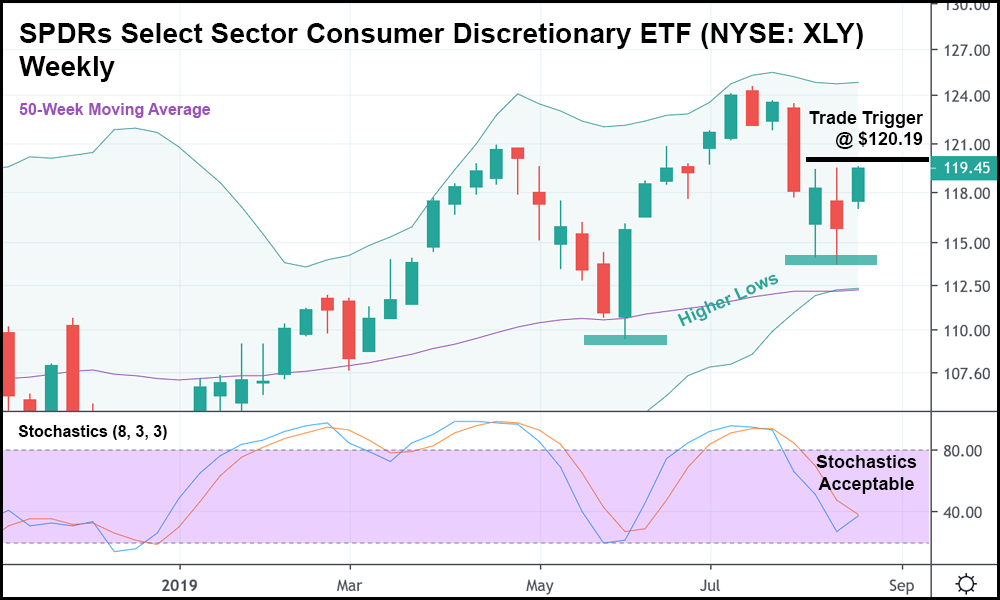

In the weekly candlestick chart above, you can see that the XLY is doing all the right things to indicate that an uptrend is on the way.

A higher low was just recently set relative to the low of June and the stochastics are coming in just below 40, which suggests that there’s more room for the XLY to run. The 50-week simple moving average is trending upwards as well.

Most importantly, however, is that the current weekly candlestick is above the last two (including the highs of the last two weeks), meaning that our entry point is drawing closer by the day.

From where the XLY currently stands, it might make sense to set a trade trigger just north of the high of the last two weeks.

Should that price threshold be eclipsed, consumer confidence would likely soar, only intensifying the XLY’s surge as consumer discretionary stocks get a lift from bulls.

It might be easy these days to feel pessimistic about the market with a trade war raging and financial headlines telling us that we’re all doomed.

However, the truth is that consumer discretionary spending is still riding high. That’s not to say that it’ll stay this way forever. It probably won’t.

But as long as the opportunity is there, we might as well make a bit of “easy” money when stone-cold uptrend continuations are staring us in the face.

Just like the XLY is doing right now.