Home computers, as you may know, have been around for a long time. Initially billed as productivity machines (they still are), they cost a small fortune, but allowed consumers to make quick work of mundane tasks.

Over time, the home computer became the personal computer (PC) – tailored to the needs of each individual user. Your hopes, dreams, and everything in-between could be stored on a hard drive.

So long as the files weren’t too big.

That includes music files, which in 1999, became forever linked with PCs when Napster, a peer-to-peer file sharing service, went online. For two years, Napster undermined the music industry, as it allowed moderately tech-savvy users to share songs (among other things) with each other.

In 2001, Napster got the axe from the RIAA, as the service facilitated the transfer of copyrighted materials. Other, more discrete services popped up over time to take its place, but Napster was the first.

And even though the controversial network was shut down after just a couple of years, it had a profound impact on how people viewed their computers. These weren’t just business machines or nerdy gaming devices – they were where we stored all our media.

In 2002, after Napster disappeared, Pandora – a music streaming service founded in 2000 – became extremely popular. Charging customers a small monthly fee, they were treated to A.I. curated internet radio stations that chose songs within specified genres at random. Users couldn’t pick out the specific tracks they wanted, but Pandora offered a legal alternative to Napster’s shady successors. Most importantly, it was cheap.

Fast forward to six years later, and the music streaming game changed again. Spotify released its app on October 7, 2008, which allowed users to play specific songs, albums, and artists as they desired. It cost more than Pandora, but offered a far superior service. Pandora’s userbase dropped dramatically, as customers flocked to the “beefier” music streaming solution.

Then, a little less than ten years later (and after immense growth), Spotify went public. On April 3, 2018, SPOT opened for trading at $165.90 per share. Investors initially went wild for the new stock, buying it up to almost $200 – its all-time high. Since then, however, share prices have plummeted. Much of SPOT’s decline can be blamed on a horrendous general market that dominated smaller stocks in Q4 2018.

However, in 2019, SPOT didn’t follow the indexes during their collective recovery. Instead of rallying like most other stocks, SPOT corrected back down to its 2018 lows.

But now, after months of selling, it looks like SPOT might be mounting a recovery that could have IPO participants sighing in relief…

…And short-term traders ready to go long.

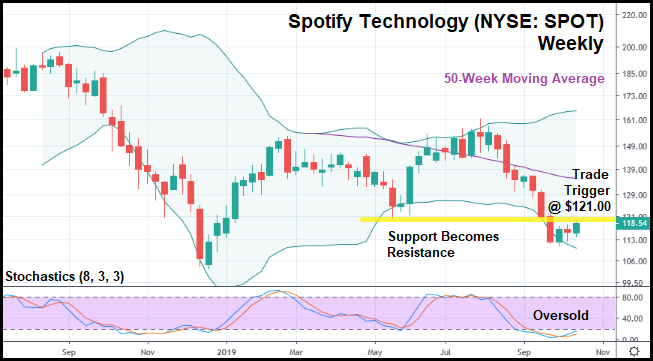

In the weekly candlestick chart above, you can see how SPOT behaved over the last year. Like I said, it’s struggled to stay afloat in 2019. And after the last correction (starting in August), the stock may finally be climbing out of the depths.

Contact with the lower Bollinger Band (BB) was made three weeks ago, and SPOT shares are butting up against key resistance at $120.00, which used to be a level of support before SPOT broke through it in September.

The current weekly candlestick is trading above the last two. Normally, I’d like to see it clear a longer range of candlesticks, but because we have recent contact with the BB, the price is acceptable as is. Also, because SPOT is so close to moving past key resistance, we can’t really wait for it to put any more candlesticks in its shadow.

Lastly, the stochastics make the stock appear woefully oversold. They haven’t been this low since the major sell-off from September-December 2018. SPOT also stopped the bleeding at a higher low relative to that December low, meaning that this technically could be an uptrend indicator. The last low is a lower low relative to the May 2019 low, but it’s still above the all-time low, which is a good sign.

If SPOT can clear key resistance, going long at a trade trigger of $121.00 might make sense. It’s a stock that, despite getting beaten up over the last year, still looks to have plenty of fight in it.

And for short-term traders, that’s a recipe for surprisingly quick, impressive gains, no matter how you slice it.