In a recent Bankrate survey (submitted to thousands of investors), the following question was asked:

“For money you wouldn’t need for more than 10 years, which ONE of the following do you think would be the best way to invest it—stocks, bonds, real estate, cash, gold/metals, or bitcoin/cryptocurrency?”

The winner, by a large margin, was real estate.

Surprised?

You shouldn’t be. With interest rates scraping the bottom of the barrel, the housing market is red-hot.

And based on how the central banks of the world have been acting, we could stay in a perma-low rate environment for decades to come.

Meaning that so long as debt is cheap, real estate will continue to impress as buyers keep on borrowing.

So, with a dwindling supply of homes being snapped up left and right, the demand for new properties is likely to rise dramatically.

Which will give homebuilders plenty of work, and more importantly, tons of room to grow.

Like the following stock that’s gearing up to lead the way in what’s become a revitalized sector.

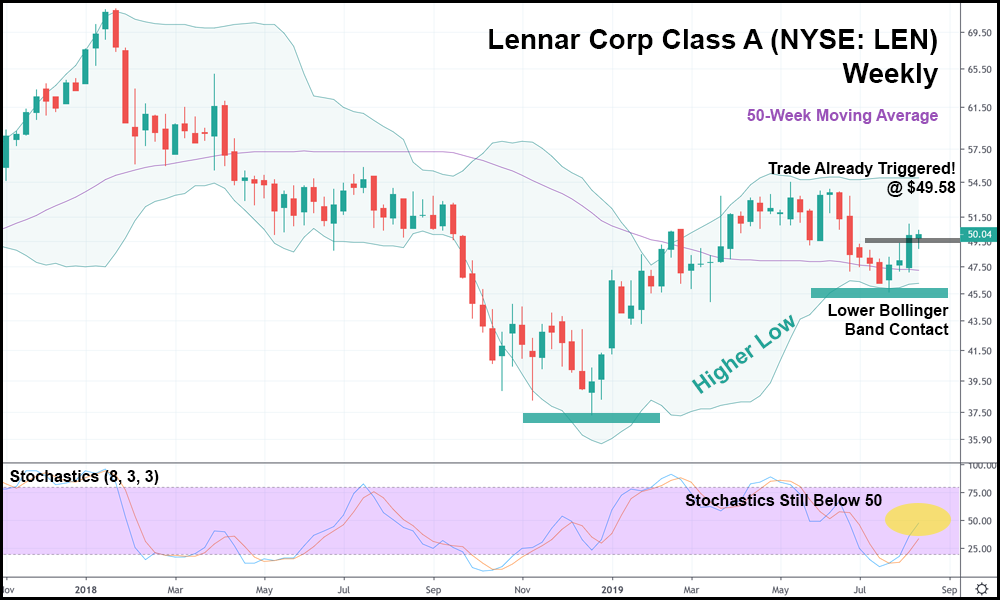

In the weekly candlestick chart above, you can see that LEN is in prime position for a further move upwards. Share prices actually triggered a long position last week, but I decided to hold off on any deeper analysis until I had more data.

Specifically, I was worried that it would sink on Monday, weighed down by a stressed-out market.

And prices ended up dropping as predicted, however not as much as I initially suspected. That’s great news, though, because it puts LEN back in a “buyable range”. What I mean is that shares haven’t risen high enough (yet) to make this trade too risky to enter.

By and large, you never want to hop into a trade that’s already moved too much in one direction. Doing so increases the chances of loss on a sudden retracement and makes intra-day trading necessary in some cases.

Worst of all, it leads to more stress – something you definitely don’t need any more of.

Especially when it comes to investing.

So, LEN still sits in a great spot for our purposes. In addition, a higher low has been set relative to the low from December 2018 and contact with the lower Bollinger Band has been made. Stochastics are below 50 despite the recent surge and most importantly, we had share prices blow past resistance at $49.50 (the high of the July candlesticks).

LEN’s a great looking stock all on its own, but it becomes even more attractive when you consider what investors believe about real estate these days. Even if the real estate market doesn’t outperform over the next decade, the belief right now that it eventually will could end up helping out plenty of real estate-related stocks in the near future.

Homebuilders like LEN included.