The once smoking-hot pot sector has officially cooled. With federal regulators still dragging their feet stateside, pot bulls have grown increasingly frustrated, waiting for the other shoe to drop on full legalization.

Or, at the very least, a nudge in the right direction.

But by and large, that hasn’t happened. The Feds are too busy at the moment to make pot a priority, even though state-level legislators are eagerly clearing paths for the big Canadian cannabis firms.

It’s a slow process, though, and the end result is a pot stock market that’s completely stagnated. Yes, there have certainly been ups-and-downs, but companies like Canopy Growth Corporation (NYSE: CGC) are right back where they were in August of last year.

Aurora Cannabis (NYSE: ACB) and Cronos Group (NASDAQ: CRON) are in the same boat – “stuck” near key support from 2018.

However, unlike ACB and CRON, CGC is finally starting to recover. And while the last few weeks have been encouraging, the top pot stock might push further upwards, revealing a major uptrend reversal on the horizon.

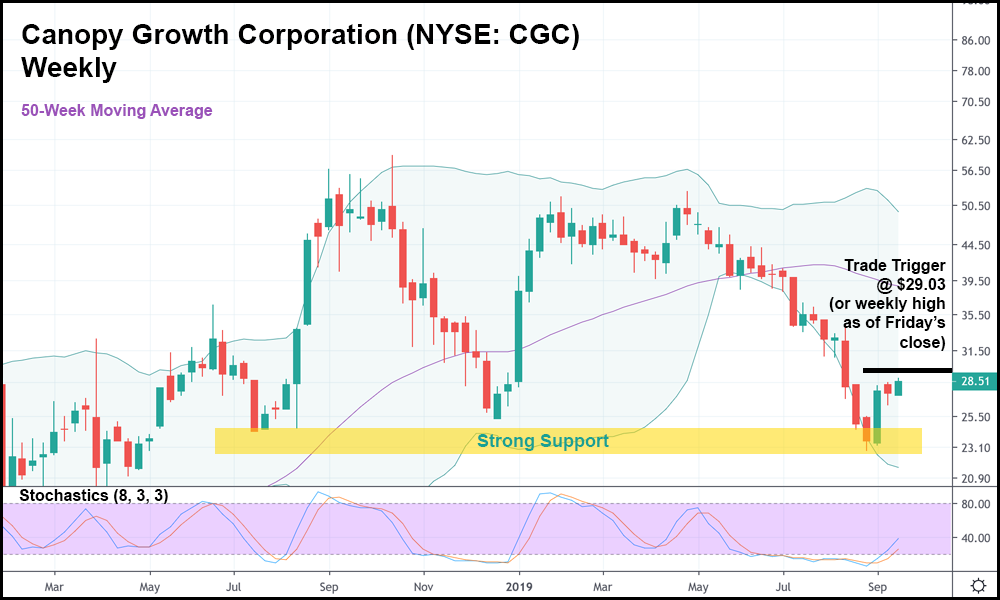

In the weekly candlestick chart above, it’s quite clear that CGC could finally be gathering strength after months of selling. Just three weeks ago, share prices bounced off key support (and the lower Bollinger Band), rebounding mightily over the next 5 trading sessions.

From there, CGC stalled a bit (last week), but continued its winning ways just a few days later.

And this week, CGC could potentially go even higher. In fact, based on what’s happened over the last year, I’d say it’s likely.

Because since August of 2018, CGC has absolutely refused to drop below support. In fact, the last encounter marked the third time it happened in a little over a year, and CGC managed to stay afloat.

That means that if CGC can close out the current week above the last four candlesticks (which it’s barely doing now), it might make sense to go long slightly above the current week’s high ($29.03 as it stands). If that high rises as of Friday (when the weekly candlestick closes) you’d just move the trade trigger to slightly above the new, higher weekly high.

Better yet, CGC looks like it formed a double top in addition to the triple bottom. So, if share prices rise up to key resistance at around $56.50, CGC might present us with an opportunity to go short, mimicking Corning’s (NYSE: GLW) movement in many ways – a ping-ponging stock we’ve featured on three occasions now.

So, as pot stocks begin heating up yet again, keep an eye out for CGC’s weekly close on Friday. If shares remain where they currently are (or head a little higher), opportunistic traders could be treated to a rip-roaring rally.

Even if CGC currently looks a little “over baked”, relatively speaking.