The market is rising, unemployment is low, and Christmas is almost here.

In other words, it’s a good time to be a bull.

Throw in the “phase one” trade deal and you’ve got near-perfect conditions for a continued bull market.

And though equities seem poised to rise in 2020, gold does as well.

Huh?

Precious metals – which usually draw investor interest when the market is struggling – have dropped since September. Before that, though, they (along with gold) went straight up most of the year – mirroring the general market.

It’s a perplexing phenomenon that has both gold bugs and traditional investors a little confused. Isn’t gold supposed to appreciate in response to economic worries (specifically inflation)?

Yes and no. That may have been true in the past, but these days, gold is more of an “uncertainty hedge” than anything else. It shoots up in price whenever a negative trade war headline wrecks the market, or something else happens – like the Saudi Aramco oil strike – clouds the foreseeable future.

And in response to the phase one trade deal, which barely qualifies as a deal, it looks as though gold is becoming popular once again.

As a result, gold-related stocks are rising too. Take, for example, Kinross Gold Corp (NYSE: KGC), whose shares appear primed to burst.

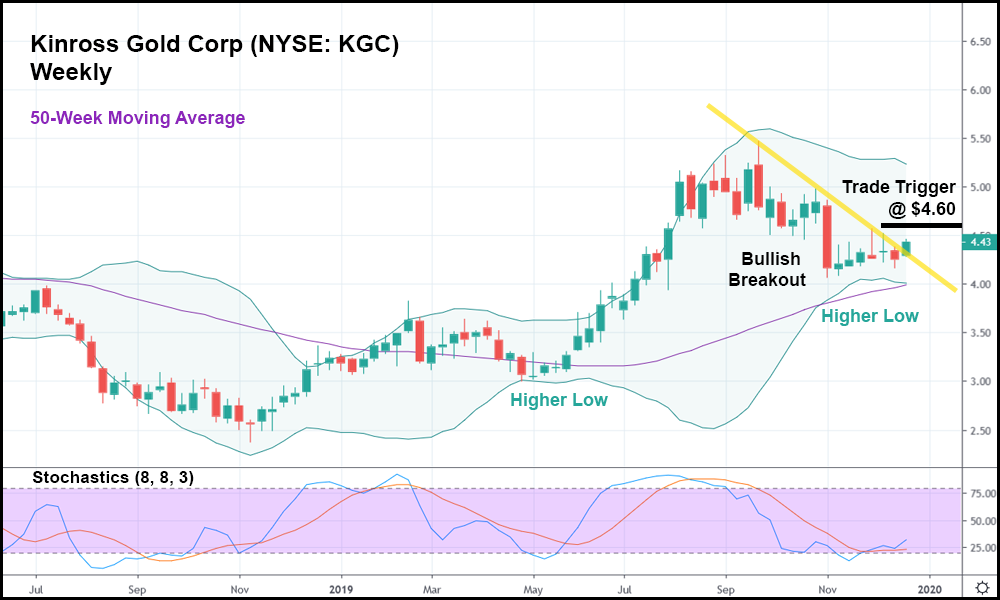

In the weekly candlestick chart above, you can see that KGC just broke out past its minor bearish trend. We drew a trendline connecting the standout highs since September, which have more or less kept KGC down.

But now, after rising above the trendline, KGC is on pace to confirm a bullish breakout. The current weekly candlestick is trading above the last six candle bodies, the 50-week moving average is rising, and the stochastic indicator remains low.

Best of all, KGC set two higher lows this year, suggesting that an uptrend continuation is inevitable in the wake of a very strong 2019 performance.

Should KGC close out the current weekly candlestick above the trendline, it might make sense to go long above the weekly high (whatever that may be on Friday), with a trade trigger (as it stands) at $4.60.

An appropriately priced and dated call option could do very well here, even if KGC doesn’t surpass the high from September.

So, on Friday, take a look at KGC to see where it’s trading. If it manages to stay at roughly the same spot (or trade higher), it might be worth a second look.

Especially if the general market is slowing down.